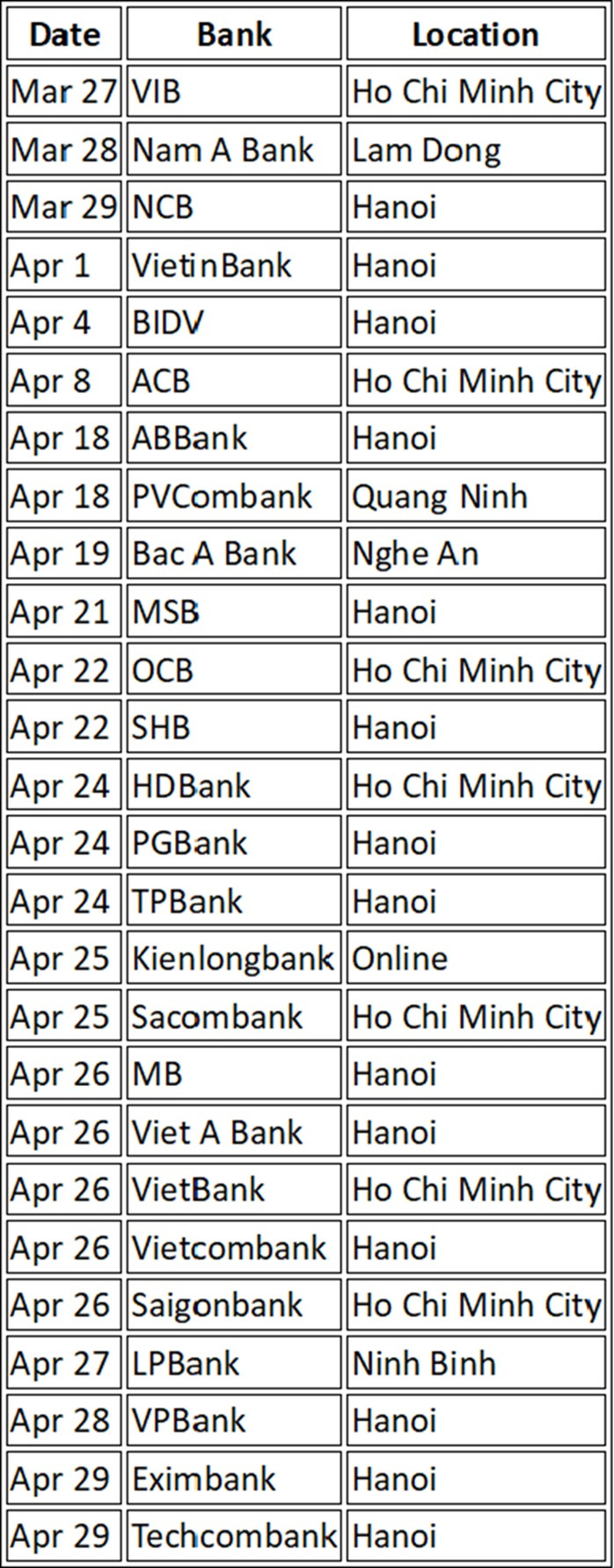

The annual general meeting (AGM) season for Vietnam’s commercial banks is underway, with most meetings concentrated in April 2025. Several joint stock commercial banks have already finalized their meeting schedules.

VIB, Nam A Bank, and NCB successfully held their 2025 AGMs on March 27, 28, and 29, respectively.

At its AGM, VIB approved its 2025 business plan with a targeted pre-tax profit of VND 11.02 trillion (approx. USD 445 million), marking a 22% increase from 2024.

VIB will distribute cash dividends equivalent to 7% of its charter capital (VND 29.79 trillion as of December 31, 2024), amounting to more than VND 2.085 trillion (approx. USD 84 million).

Additionally, the board proposed increasing charter capital through the issuance of over 417 million bonus shares to existing shareholders and 7.8 million bonus shares to employees. This move will raise the bank’s charter capital by approximately VND 4.25 trillion (USD 172 million), bringing it to around VND 34.04 trillion (USD 1.37 billion). Post-tax profit remaining after fund allocations and dividend payments is estimated at over VND 4 trillion (USD 162 million).

Nam A Bank’s AGM approved its 2025 key business targets, including a consolidated pre-tax profit of VND 5 trillion (USD 202 million), total assets of VND 270 trillion (USD 10.9 billion), and total capital mobilization from individuals, organizations, and bond issuances of VND 209 trillion (USD 8.46 billion). Its loan portfolio is expected to reach VND 194 trillion (USD 7.85 billion), while complying with all regulatory safety ratios.

Nam A Bank shareholders also agreed to increase the bank’s charter capital by more than VND 4.281 trillion (USD 173 million), from over VND 13.725 trillion (USD 554 million) to over VND 18 trillion (USD 726 million). The capital increase will be implemented through the issuance of shares from equity and an employee stock ownership plan (ESOP).

At NCB, shareholders approved a 2025 business plan targeting total assets of VND 135.5 trillion (USD 5.47 billion), customer deposits of VND 118.5 trillion (USD 4.79 billion), reflecting growth of 14.6% and 23.2% respectively compared to 2024. Loans to customers are projected to increase 30% to VND 92.528 trillion (USD 3.74 billion).

NCB also set a pre-restructuring profit target of VND 59 billion (USD 2.38 million), with a commitment to use all profits to implement its approved restructuring plan.

The bank’s AGM approved a capital increase plan of VND 7.5 trillion (USD 302 million) via the private placement of 700 million shares - equivalent to 59.42% of NCB’s charter capital at the time of issuance - at a price not lower than VND 10,000 per share.

Upon completing the capital increase, NCB’s charter capital will rise from VND 11.78 trillion (USD 476 million) to VND 19.28 trillion (USD 779 million).

The 2025 AGM also approved a plan to privately issue convertible bonds worth up to VND 2 trillion (USD 80.5 million), or equivalent in foreign currency. A total of 20,000 bonds will be issued with a maximum term of five years. The issuance will take place domestically or internationally, with the board authorized to determine the market.

Among the remaining banks, VietinBank will hold its AGM on April 1, followed by BIDV on April 4 and Vietcombank on April 26.

After hosting two extraordinary general meetings in Hanoi, Eximbank will, for the first time, hold its annual AGM in Hanoi on April 29. Agenda items include the election of the Board of Directors and Supervisory Board for the 2025–2030 term, along with other issues.

2025 ANNUAL GENERAL MEETING SCHEDULE FOR VIETNAMESE BANKS

Tuan Nguyen