After national reunification in 1975, Vietnam entered a phase of economic restoration and post-war reconstruction. This was a tremendously challenging time, with the entire country facing depleted resources, damaged infrastructure, and a labor shortage.

In this context, the demand for motorized transport became more urgent than ever, playing a vital role in national reconstruction, materials transport, and civil logistics to support economic development.

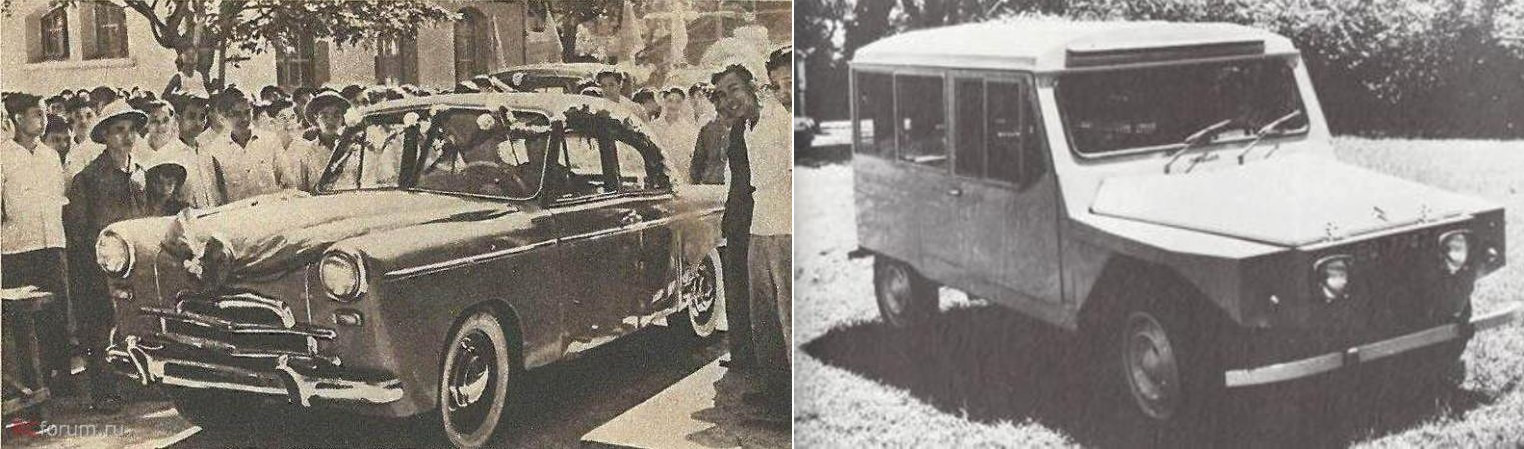

It was during this crucial phase that Vietnam's automotive industry began to take shape from virtually nothing. Initial mechanical and vehicle repair workshops emerged, mainly derived from military factories or state-owned enterprises. The goal at the time was not to manufacture new vehicles, but to assemble, refurbish, and repurpose military trucks and government utility vehicles to meet domestic needs.

One of the pioneers in this space was the Ngo Gia Tu Automotive Mechanical Factory, known for its work in repairing and assembling vehicles. It served not only state agencies but also helped train engineers and technicians for Vietnam's fledgling automotive industry.

In the South, the Saigon Automotive Mechanical Plant also laid important groundwork for the development of the region's mechanical and automotive sectors after liberation.

From 1975 to 1990, this period is regarded as the formative phase of Vietnam’s automotive industry - the sowing of seeds for future growth. While the country did not yet have a true Vietnamese auto brand, the spirit of self-reliance and the perseverance of engineers and workers laid a crucial foundation for what was to come.

Despite technological limitations, outdated equipment, and limited investment capital, this period allowed the industry to accumulate practical experience and develop a technically skilled workforce. Projects that repurposed trucks into cargo or utility vehicles and rudimentary assembly efforts became the first building blocks of the Vietnamese dream to master car production - even in times of extreme hardship.

The era of Doi Moi (Renovation) marked a turning point. As Vietnam opened its economy to foreign investment, the domestic automotive industry turned a new page.

In 1991, the government issued Decree 53/NĐ-CP on automotive industry development, aiming to make it a key economic sector. This decree unlocked immense growth potential.

That same year, a tripartite joint venture between Vietnam, South Korea, and Japan established Mekong Auto (with shares split 30% Vietnam, 19% South Korea, and 51% Japan). Leveraging advanced technologies from both partner countries, Mekong Auto launched the Mekong Star - Vietnam’s first four-wheel-drive SUV - within a year. Produced at the Cuu Long factory in Ho Chi Minh City, it used engines supplied by South Korea’s Ssangyong Motor.

In 1993, the Mekong Star was exported to Japan and China, marking Vietnam’s entry into Asia’s automotive export market.

In 1994, three major global automakers - Toyota, Ford, and Chrysler - established joint ventures in Vietnam, signaling a new era where Vietnamese consumers gained access to world-leading car brands. Eventually, 16 major foreign-invested automotive firms entered the Vietnamese market, including Mercedes-Benz, Honda, Toyota, Ford, Mitsubishi, and Suzuki.

The market quickly became more dynamic as foreign brands began assembling vehicles locally instead of importing them, offering greater variety and accessibility.

In the early days of economic reform and market liberalization, the Vietnamese automotive industry saw the birth of its first joint ventures. Among the most notable were VIDAMCO and Hoa Binh Automobile Joint Venture (VMC), two pioneers that helped shape the domestic car market in the 1990s.

VMC was established in 1991 by Vietnam Engine and Agricultural Machinery Corporation (VEAM) in partnership with major foreign companies, particularly KIA Motors (South Korea) and BMW (Germany). Throughout the 1990s, VMC assembled models familiar to Vietnamese consumers, such as the KIA Pride, Mazda3, and BMW 3- and 5-series.

VIDAMCO (Vietnam Daewoo Motor Company), founded in 1993, was a joint venture between TRANSINCO and Daewoo Motor (South Korea). It focused on assembling and distributing popular models like the Cielo, Lanos, Nubira, Matiz, and Lacetti - vehicles well-regarded for affordability and modern design.

However, both ventures faced major hurdles due to low localization rates. Their heavy reliance on foreign technology and imported parts made their cars expensive and limited the development of domestic supporting industries.

Though their journeys ended, names like Mekong Auto, VIDAMCO, and VMC laid the initial bricks of Vietnam’s automotive industry - paving the way for deeper investment in the decades to follow.

In 2004, a major shift occurred when two Vietnamese-branded car companies were granted production licenses: Truong Hai Auto Corporation (THACO) and Xuan Kien Auto Corporation (Vinaxuki). Initially, both focused on assembling commercial vehicles under license from global manufacturers for the local market.

Driven by the ambition to create a truly Vietnamese brand, Vinaxuki - founded by Bui Ngoc Huyen - pivoted to manufacturing passenger cars. However, due to capital constraints and product quality issues, Vinaxuki shut down in early 2012, putting its dream on hold.

THACO pursued a different path. Initially focusing on assembling and distributing foreign-brand vehicles, it later expanded into trucks, commercial vehicles, and buses. Over time, THACO, led by Chairman Tran Ba Duong, built one of the most advanced auto manufacturing complexes in Vietnam at Chu Lai, Quang Nam.

Following THACO’s lead, Thanh Cong Group partnered with Hyundai Motors (South Korea) to form the Hyundai Thanh Cong Vietnam Joint Venture (HTV), producing popular Hyundai models at its factory in Ninh Binh - such as the i10, Accent, Elantra, Tucson, and Santa Fe. Thanks to reasonable pricing, modern design, and solid quality, Hyundai quickly gained a large share of the passenger car and family vehicle market.

This period marked a significant chapter in Vietnam’s automotive journey. While foreign joint ventures like Toyota, Ford, and Honda expanded, domestic companies increasingly asserted their position by investing in manufacturing, automation, and component supply chains. These efforts significantly boosted localization, especially in affordable trucks and passenger vehicles.

Over the past decade, Vietnam's automotive industry has made remarkable strides - transforming from a consumer market into a manufacturer and exporter. A domestic production ecosystem has begun to take shape, with strong participation from local firms and international joint ventures.

Leading this wave of growth is VinFast - Vietnam’s first indigenous automotive brand, established by Vingroup in 2017. Just two years later, it unveiled its first model in 2019 - an impressive pace that stunned industry observers. Not content with internal combustion cars, VinFast quickly pivoted to electric vehicles, aligning with global trends.

In late 2022, VinFast made history by exporting its first batch of 999 VF 8 EVs to the U.S., followed by launches in Canada, Europe, and Southeast Asia. This bold move demonstrated Vietnam’s growing presence on the world’s automotive map and signaled its global ambitions and manufacturing capabilities.

In 2024, VinFast sold over 97,000 vehicles, including approximately 87,000 in Vietnam and more than 10,000 abroad. That year, VinFast also achieved a landmark by becoming the best-selling car brand in Vietnam - the first time a domestic brand outperformed foreign giants on home turf.

Yet VinFast is not alone in building Vietnam’s auto industry.

THACO remains one of Vietnam’s largest private auto manufacturers, producing a wide range of vehicles from passenger cars to trucks and buses. Since 2015, THACO has invested heavily in supporting industries, producing parts and components domestically to reduce reliance on imports.

In 2024, THACO sold 90,989 vehicles, representing 26.8% of the market and topping all members of the Vietnam Automobile Manufacturers Association (VAMA).

Thanh Cong Group, through HTV, also made key contributions by assembling Hyundai vehicles and investing in component production. It inaugurated its second factory in Ninh Binh in 2022.

HTV made headlines in October 2024 by exporting a batch of Hyundai Palisade SUVs to Thailand - with over 40% localized content - marking the first time Vietnam exported passenger cars to a country widely considered the regional automotive hub.

In 2024, HTV recorded sales of 67,168 units, accounting for 13.58% of the total national sales volume of about 494,300 vehicles (including VAMA, HTV, and VinFast).

Together, these three domestic enterprises accounted for 49.6% of all vehicles sold in Vietnam in 2024 - a figure that inspires national pride.

Thanks to joint efforts by domestic and joint-venture firms, Vietnam's automotive industry is gradually building a full supply chain - from design and engineering to manufacturing, distribution, and after-sales service. Logistics, warehousing, and seaport infrastructure are also being upgraded to better support exports and domestic circulation.

Despite this progress, challenges remain. Technological capabilities are still uneven, particularly in the field of new-energy vehicles, which demand advanced systems - from batteries and controllers to charging stations and smart infrastructure. Additionally, Vietnam’s domestic market is still small compared to regional peers like Thailand or Indonesia, making economies of scale harder to achieve.

Nonetheless, Vietnam has favorable conditions: political stability, open policies, a young population, rising incomes, and strong demand despite low car ownership rates. These create ample opportunities for local companies to grow and compete - both domestically and internationally.

Once seen as a "rookie" in the global auto scene, Vietnam is now undergoing a powerful transformation. Companies like THACO, Hyundai Thanh Cong, and especially VinFast have led this remarkable rise - driving the Vietnamese automotive industry into a new era.

Hoang Hiep