The announcement was made by Pham Anh Tuan, Director of the Payment Department of the State Bank of Vietnam, during a press briefing in Ho Chi Minh City on June 2, introducing the “Cashless Day 2025” initiative.

According to Pham Anh Tuan, Circular No. 40, which regulates intermediary payment services, has recently been revised by the State Bank to introduce greater flexibility and facilitate the growth of the digital payments sector.

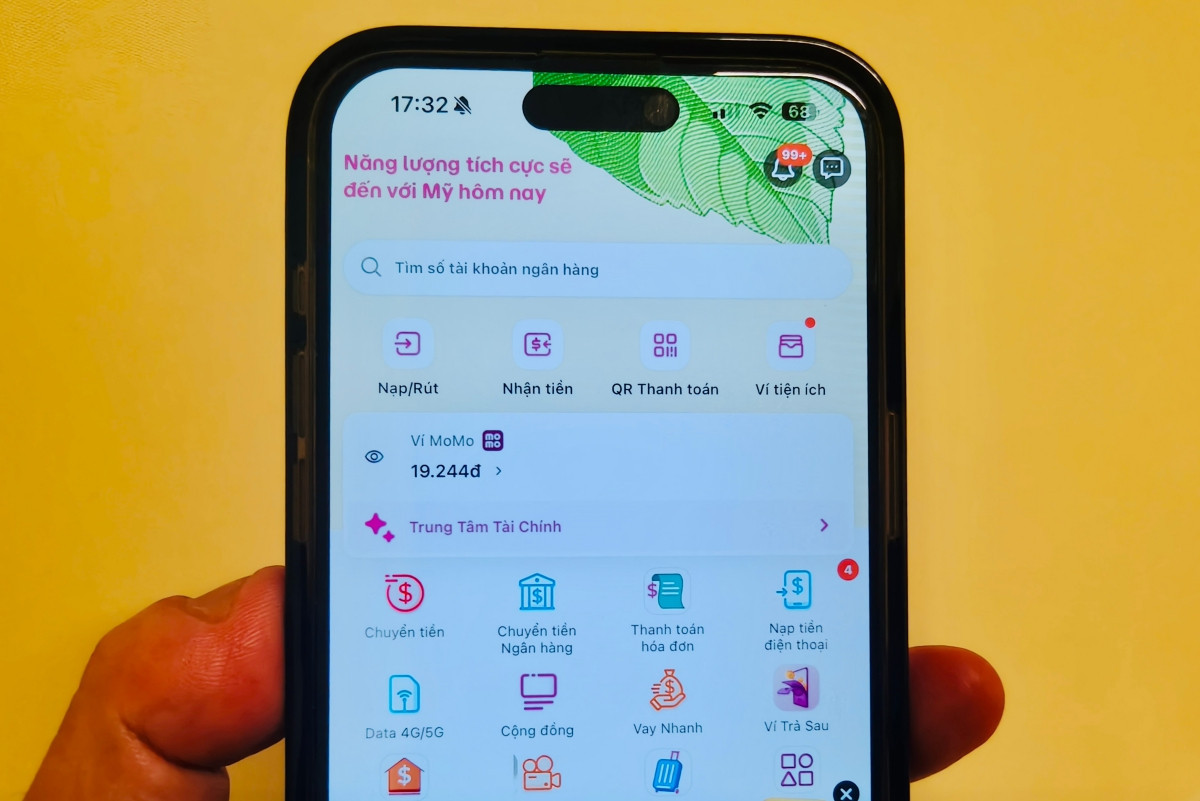

Tuan confirmed that from July 1, 2025, e-wallets will become an official form of payment. They will function similarly to bank accounts, cards, or physical cash, allowing users to make payments across all sectors - not just for purchasing goods or services.

Users will be able to transfer funds between wallets, from wallet to bank account and vice versa, without needing to route transactions through a linked bank account. This increased functionality expands the potential of e-wallets, particularly in penetrating remote areas and delivering financial services more broadly.

The State Bank is currently amending Circular No. 40, with a revised version expected to take effect on September 1, 2025. These changes aim to support the development of e-wallet services while ensuring that service providers strictly comply with legal regulations and do not facilitate fraud, black credit, illegal betting, or unauthorized trading platforms.

As of March 31, 2025, there were 47 licensed organizations providing e-wallet services in Vietnam. Approximately 30.27 million wallets were actively in use, accounting for 65.8% of the nearly 46.01 million wallets that had been activated. The total balance across these active wallets exceeded VND 2.8 trillion (approximately USD 110 million).

Le My